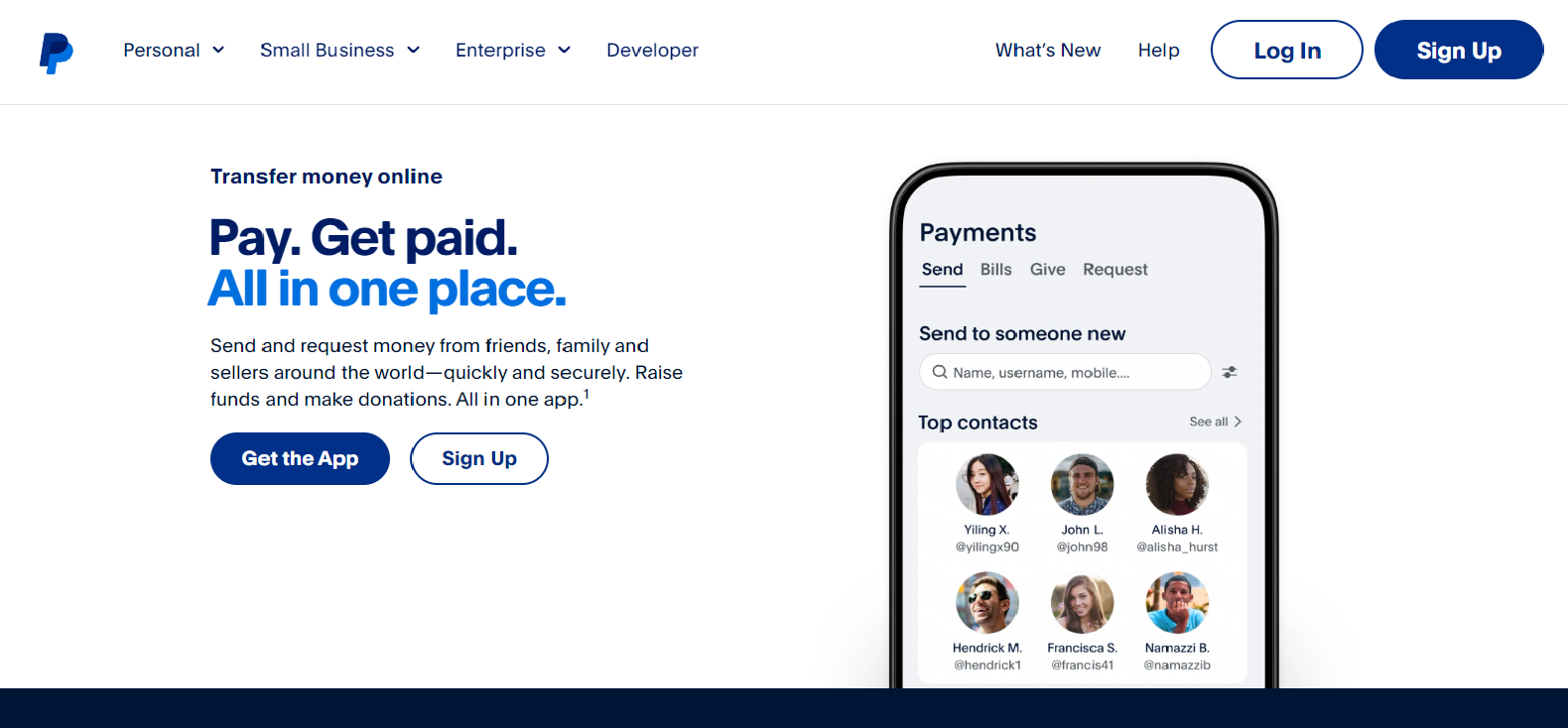

When it comes to online transactions, few names are as ubiquitous and trusted as PayPal.com. Established in 1998, PayPal.com has become a cornerstone of online commerce, enabling seamless and secure transactions for both consumers and businesses alike. But what makes PayPal.com stand out in a crowded field of digital payment platforms? Let’s delve into its trustworthiness, how it stacks up against competitors, its pros and cons, and compelling reasons to start using PayPal.com today.

Is PayPal.com Trustworthy?

Trust is paramount in any financial transaction, and PayPal.com has built a stellar reputation over the years. With robust security measures, including encryption and anti-fraud technologies, PayPal.com ensures that users’ personal and financial information is well-protected. The company is regulated in various jurisdictions and complies with strict financial standards, adding another layer of credibility.

Moreover, PayPal’s Buyer Protection and Seller Protection programs provide an extra layer of security. Buyers can shop with confidence, knowing they can get refunds for items that are significantly not as described or not received. Sellers, on the other hand, are safeguarded against unauthorized transactions and claims of non-receipt.

PayPal.com compared to Competitors

In the realm of digital payments, PayPal.com faces stiff competition from platforms like Stripe, Square, and Apple Pay. PayPal.com operates in over 200 countries and supports 25 currencies, making it a truly global payment solution. Competitors like Stripe and Square are more region-specific, limiting their utility for international transactions. With over 400 million active users, PayPal’s extensive user base is a testament to its popularity and reliability. This widespread adoption makes it easier for users to transact with a larger number of merchants and peers.

PayPal.com offers a wide range of services beyond simple peer-to-peer payments, including merchant services, invoicing, and even credit and financing options. This versatility is a significant advantage over more specialized competitors.

Pros and Cons of PayPal.com

Pros

- Ease of Use: PayPal’s intuitive interface and seamless integration with thousands of online retailers make it incredibly user-friendly.

- Security: Advanced security features and strong encryption ensure that user data is protected.

- Wide Acceptance: Accepted by millions of merchants worldwide, PayPal.com is one of the most versatile payment options available.

Cons

- Fees: PayPal’s fee structure can be higher than some competitors, particularly for international transactions and currency conversions.

- Account Holds: Some users have reported account holds and limitations, which can be frustrating if funds are needed urgently.

Three reasons to use now PayPal.com

- Seamless Shopping Experience: PayPal’s one-touch checkout feature simplifies the purchasing process, making it faster and more convenient than ever. No need to repeatedly enter your payment information; just click and buy.

- Security and Buyer Protection: Shop with peace of mind knowing that your transactions are secure and that you’re protected by PayPal’s Buyer Protection policy.

- Rewards and Benefits: Many merchants offer exclusive discounts and promotions for PayPal.com users. Additionally, linking your PayPal account to credit cards can help you earn rewards points on your purchases.