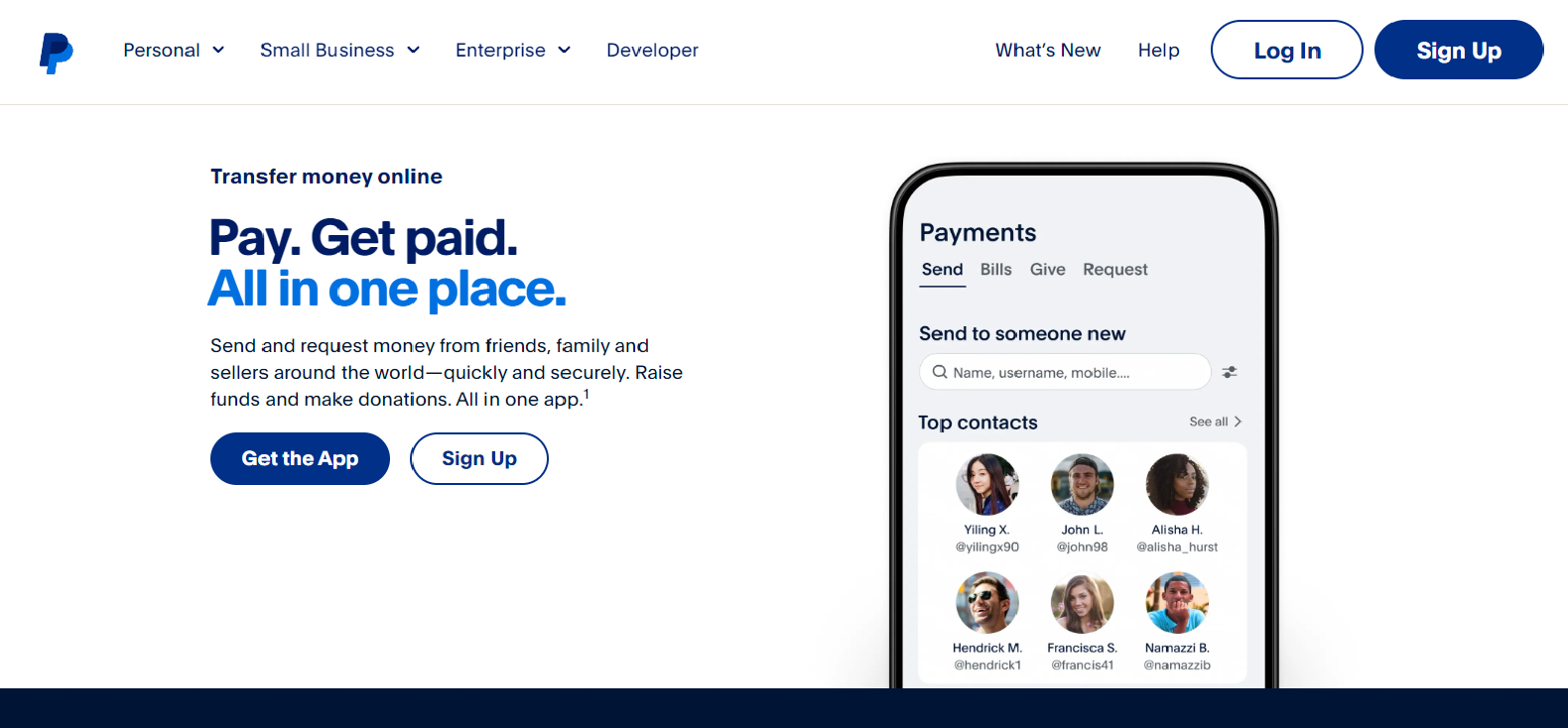

In today’s digital age, seamless and secure online transactions are essential. PayPal.com has long been a dominant force in online payments, offering users around the globe a trusted and convenient way to send, receive, and manage money. Whether you’re a frequent online shopper, a small business owner, or simply someone who needs to transfer funds quickly, PayPal.com claims to be the go-to solution. But is PayPal.com still the best option in 2024? This in-depth review will explore PayPal’s trustworthiness, compare it with its competitors, analyze its pros and cons, and provide compelling reasons why you should consider PayPal.com for your online financial needs.

Is PayPal.com Trustworthy?

One of the most crucial aspects of any online financial service is trustworthiness, and PayPal.com has a long-standing reputation for being a reliable and secure platform. Founded in 1998 and now a global leader in digital payments, PayPal.com handles over 430 million active accounts worldwide. Its key selling points include secure encryption technologies, buyer and seller protection, and strict compliance with financial regulations. PayPal.com implements multiple layers of security, including two-factor authentication (2FA), fraud monitoring, and encryption to safeguard user data.

Moreover, PayPal.com offers Buyer Protection that ensures refunds for purchases that are not as described or fail to arrive, a feature that continues to set it apart in the industry. For sellers, Seller Protection safeguards against fraudulent claims and chargebacks. The company is also regulated by financial authorities around the world, which further solidifies its reputation as a trusted financial service provider.

PayPal.com Compared to Competitors

PayPal’s main competitors in the digital payments landscape include Stripe, Square, Venmo (which PayPal actually owns), and Zelle. Here’s how PayPal.com compares:

Stripe: While Stripe is more popular among businesses for handling online payments, its platform is more developer-focused. It offers great customizability but is less user-friendly for the average consumer. Stripe lacks PayPal’s widespread name recognition and protection services for buyers and sellers.

Square: Square is better suited for brick-and-mortar businesses and point-of-sale systems but lags behind PayPal.com in terms of its global reach and online usability. PayPal’s integration with thousands of websites makes it a more versatile option for digital shoppers.

Venmo: Venmo is a peer-to-peer payment service with a social component, but it’s mostly used for small, casual transactions among friends. PayPal.com, on the other hand, is designed for larger-scale business and international transactions, making it more versatile.

Pros and Cons of PayPal.com

Every online platform has its strengths and weaknesses. Here’s an honest breakdown of what you can expect from PayPal.com:

Pros:

- Widespread Acceptance: PayPal.com is accepted by millions of online stores and businesses globally. It’s incredibly easy to use, making it a convenient choice for consumers.

- Security Features: Robust fraud prevention tools, encryption, and purchase protection provide peace of mind for users.

- Multiple Payment Options: You can link PayPal.com to bank accounts, credit cards, and debit cards, offering great flexibility. PayPal also allows users to hold multiple currencies and transfer money internationally.

Cons:

- Account Holds: PayPal’s fraud detection system can sometimes flag transactions incorrectly, leading to temporary account limitations, which can be frustrating.

- Fees for Some Transactions: While sending money to friends and family within the same country is free, PayPal.com does charge fees for currency conversions, business transactions, and some credit card payments.

Three reasons to choose PayPal.com

- Global Reach: PayPal.com is one of the few payment platforms accepted worldwide. Whether you’re making a purchase from a local seller or an international retailer, PayPal’s extensive network makes transactions seamless across borders.

- Enhanced Security: With Buyer Protection, secure encryption, and fraud monitoring, PayPal.com offers unparalleled peace of mind for your online purchases.

- Flexible Payments: PayPal’s integration with major retailers, along with its options to link multiple payment methods, makes it an essential tool for modern online shopping. Plus, their “Pay in 4” feature allows users to split payments into manageable chunks.

Conclusion: Make PayPal.com your go-to payment platform today!

In conclusion, PayPal.com continues to be a highly trusted and reliable payment platform for millions of users worldwide. Whether you’re shopping online, running a business, or transferring funds to family members, PayPal.com offers the security, convenience, and global reach needed in today’s digital economy. While competitors like Stripe and Square offer niche solutions, none match PayPal’s comprehensive service, especially when it comes to buyer protection and ease of use.

If you’re looking for a secure, user-friendly, and globally accepted payment platform, PayPal.com is the answer. Don’t wait—sign up today, enjoy safe transactions, and take advantage of the platform’s flexible payment options!